what strategy of modern manufacturing is adam smith referring to in this statement

What Is International Merchandise?

International trade theories are simply different theories to explicate international trade. Trade is the concept of exchanging goods and services between two people or entities. International trade is then the concept of this substitution between people or entities in two different countries.

People or entities trade considering they believe that they benefit from the exchange. They may need or desire the goods or services. While at the surface, this many sound very simple, there is a great deal of theory, policy, and business strategy that constitutes international trade.

In this section, you'll learn about the unlike trade theories that accept evolved over the by century and which are most relevant today. Additionally, you'll explore the factors that touch international trade and how businesses and governments employ these factors to their respective benefits to promote their interests.

What Are the Different International Merchandise Theories?

"Effectually 5,200 years agone, Uruk, in southern Mesopotamia, was probably the starting time metropolis the world had ever seen, housing more than l,000 people inside its six miles of wall. Uruk, its agriculture made prosperous by sophisticated irrigation canals, was home to the first class of middlemen, trade intermediaries…A cooperative trade network…set the design that would endure for the next 6,000 years."Matt Ridley, "Humans: Why They Triumphed," Wall Street Journal, May 22, 2010, accessed December xx, 2010, http://online.wsj.com/article/SB10001424052748703691804575254533386933138.html.

In more than recent centuries, economists take focused on trying to empathise and explain these trade patterns. Chapter 1 "Introduction", Section 1.iv "The Globalization Fence" discussed how Thomas Friedman's flat-earth approach segments history into 3 stages: Globalization i.0 from 1492 to 1800, two.0 from 1800 to 2000, and 3.0 from 2000 to the nowadays. In Globalization 1.0, nations dominated global expansion. In Globalization two.0, multinational companies ascended and pushed global development. Today, engineering drives Globalization 3.0.

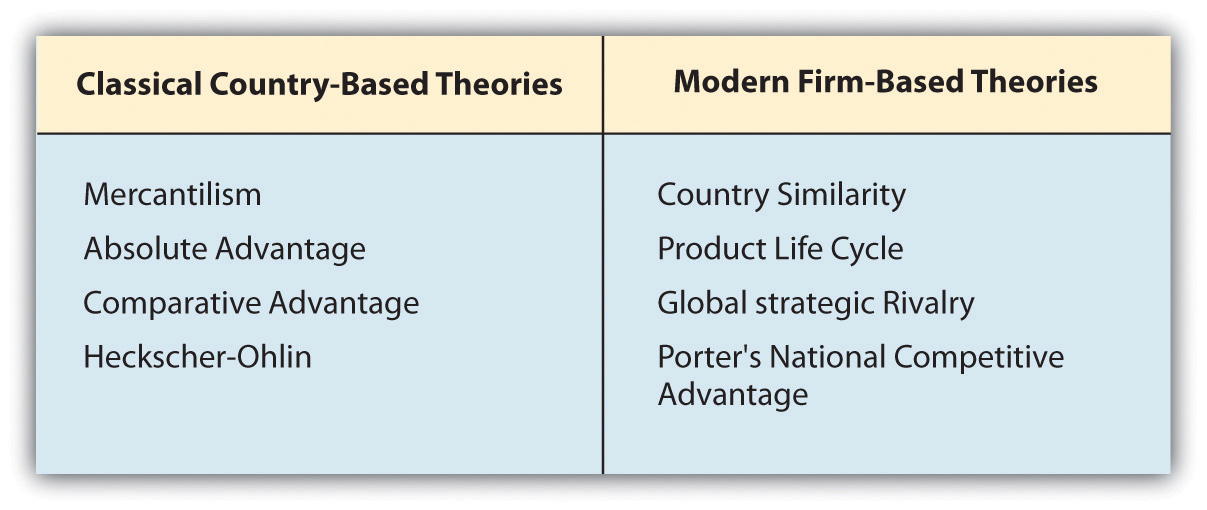

To better understand how modernistic global merchandise has evolved, it's important to understand how countries traded with one another historically. Over time, economists accept developed theories to explicate the mechanisms of global trade. The main historical theories are called classical and are from the perspective of a country, or land-based. Past the mid-twentieth century, the theories began to shift to explain trade from a firm, rather than a country, perspective. These theories are referred to every bit modern and are firm-based or company-based. Both of these categories, classical and modernistic, consist of several international theories.

Classical or Country-Based Merchandise Theories

Mercantilism

Developed in the sixteenth century, mercantilismA classical, state-based international trade theory that states that a country's wealth is determined past its holdings of gold and argent. was one of the earliest efforts to develop an economical theory. This theory stated that a country's wealth was adamant past the amount of its gilt and silver holdings. In it's simplest sense, mercantilists believed that a country should increase its holdings of gilt and silver by promoting exports and discouraging imports. In other words, if people in other countries buy more from you (exports) than they sell to yous (imports), and then they have to pay you the deviation in aureate and silvery. The objective of each country was to have a trade surplusWhen the value of exports is greater than the value of imports. , or a situation where the value of exports are greater than the value of imports, and to avoid a trade arrearsWhen the value of imports is greater than the value of exports. , or a situation where the value of imports is greater than the value of exports.

A closer look at world history from the 1500s to the belatedly 1800s helps explain why mercantilism flourished. The 1500s marked the rise of new nation-states, whose rulers wanted to strengthen their nations by building larger armies and national institutions. By increasing exports and trade, these rulers were able to amass more gold and wealth for their countries. One manner that many of these new nations promoted exports was to impose restrictions on imports. This strategy is chosen protectionismThe practice of imposing restrictions on imports and protecting domestic industry. and is still used today.

Nations expanded their wealth by using their colonies effectually the world in an endeavor to control more than trade and amass more riches. The British colonial empire was 1 of the more than successful examples; it sought to increase its wealth by using raw materials from places ranging from what are now the Americas and Bharat. France, holland, Portugal, and Spain were besides successful in edifice large colonial empires that generated extensive wealth for their governing nations.

Although mercantilism is one of the oldest merchandise theories, information technology remains part of modern thinking. Countries such as Nippon, Prc, Singapore, Taiwan, and even Germany still favor exports and discourage imports through a class of neo-mercantilism in which the countries promote a combination of protectionist policies and restrictions and domestic-manufacture subsidies. Nearly every state, at 1 indicate or another, has implemented some form of protectionist policy to baby-sit fundamental industries in its economic system. While export-oriented companies usually back up protectionist policies that favor their industries or firms, other companies and consumers are hurt by protectionism. Taxpayers pay for government subsidies of select exports in the form of college taxes. Import restrictions lead to higher prices for consumers, who pay more for foreign-fabricated appurtenances or services. Free-merchandise advocates highlight how free trade benefits all members of the global community, while mercantilism's protectionist policies but benefit select industries, at the expense of both consumers and other companies, within and outside of the industry.

Absolute Advantage

In 1776, Adam Smith questioned the leading mercantile theory of the time in The Wealth of Nations.Adam Smith, An Inquiry into the Nature and Causes of the Wealth of Nations (London: W. Strahan and T. Cadell, 1776). Contempo versions take been edited past scholars and economists. Smith offered a new trade theory called absolute advantageThe ability of a state to produce a skilful more than efficiently than another nation. , which focused on the ability of a country to produce a proficient more efficiently than another nation. Smith reasoned that trade between countries shouldn't be regulated or restricted by government policy or intervention. He stated that trade should flow naturally according to marketplace forces. In a hypothetical ii-country world, if Country A could produce a good cheaper or faster (or both) than Land B, then State A had the reward and could focus on specializing on producing that good. Similarly, if Country B was better at producing some other proficient, it could focus on specialization every bit well. Past specialization, countries would generate efficiencies, considering their labor force would become more skilled by doing the aforementioned tasks. Production would besides go more efficient, considering there would be an incentive to create faster and better production methods to increase the specialization.

Smith's theory reasoned that with increased efficiencies, people in both countries would benefit and trade should be encouraged. His theory stated that a nation's wealth shouldn't be judged by how much gold and silver it had merely rather by the living standards of its people.

Comparative Advantage

The challenge to the absolute advantage theory was that some countries may be better at producing both appurtenances and, therefore, have an advantage in many areas. In contrast, another country may not have whatever useful absolute advantages. To answer this claiming, David Ricardo, an English economist, introduced the theory of comparative reward in 1817. Ricardo reasoned that fifty-fifty if Country A had the absolute advantage in the production of both products, specialization and trade could still occur between 2 countries.

Comparative rewardThe situation in which a country cannot produce a product more than efficiently than another country; notwithstanding, it does produce that production amend and more efficiently than it does another good. occurs when a country cannot produce a production more efficiently than the other country; however, it can produce that product ameliorate and more than efficiently than it does other goods. The difference between these 2 theories is subtle. Comparative advantage focuses on the relative productivity differences, whereas accented advantage looks at the absolute productivity.

Allow'southward look at a simplified hypothetical example to illustrate the subtle difference between these principles. Miranda is a Wall Street lawyer who charges $500 per 60 minutes for her legal services. It turns out that Miranda can besides blazon faster than the authoritative assistants in her office, who are paid $forty per hour. Even though Miranda conspicuously has the absolute advantage in both skill sets, should she practise both jobs? No. For every 60 minutes Miranda decides to type instead of do legal work, she would exist giving upward $460 in income. Her productivity and income will exist highest if she specializes in the higher-paid legal services and hires the about qualified administrative assistant, who tin type fast, although a little slower than Miranda. By having both Miranda and her assistant concentrate on their respective tasks, their overall productivity as a team is higher. This is comparative reward. A person or a state will specialize in doing what they do relatively better. In reality, the world economy is more than complex and consists of more than two countries and products. Barriers to trade may exist, and goods must exist transported, stored, and distributed. However, this simplistic instance demonstrates the footing of the comparative advantage theory.

Heckscher-Ohlin Theory (Factor Proportions Theory)

The theories of Smith and Ricardo didn't help countries determine which products would give a state an advantage. Both theories assumed that free and open markets would atomic number 82 countries and producers to determine which appurtenances they could produce more efficiently. In the early 1900s, 2 Swedish economists, Eli Heckscher and Bertil Ohlin, focused their attention on how a country could proceeds comparative advantage by producing products that utilized factors that were in abundance in the state. Their theory is based on a land's product factors—state, labor, and capital, which provide the funds for investment in plants and equipment. They determined that the price of any factor or resource was a function of supply and need. Factors that were in swell supply relative to demand would be cheaper; factors in corking need relative to supply would exist more than expensive. Their theory, also called the gene proportions theoryBesides chosen the Heckscher-Ohlin theory; the classical, state-based international theory states that countries would gain comparative advantage if they produced and exported goods that required resources or factors that they had in great supply and therefore were cheaper production factors. In contrast, countries would import appurtenances that required resources that were in curt supply in their state but were in higher need. , stated that countries would produce and export goods that required resources or factors that were in great supply and, therefore, cheaper production factors. In contrast, countries would import goods that required resource that were in short supply, but college demand.

For example, China and Bharat are dwelling house to cheap, large pools of labor. Hence these countries take go the optimal locations for labor-intensive industries like textiles and garments.

Leontief Paradox

In the early 1950s, Russian-born American economist Wassily W. Leontief studied the U.s.a. economy closely and noted that the United states of america was arable in capital and, therefore, should export more uppercase-intensive goods. Yet, his research using actual data showed the opposite: the The states was importing more uppercase-intensive goods. According to the factor proportions theory, the United States should have been importing labor-intensive goods, but instead it was actually exporting them. His analysis became known every bit the Leontief ParadoxA paradox identified by Russian economist Wassily W. Leontief that states, in the real world, the reverse of the cistron proportions theory exists in some countries. For example, even though a country may be abundant in capital, information technology may all the same import more majuscule-intensive appurtenances. considering it was the reverse of what was expected past the factor proportions theory. In subsequent years, economists have noted historically at that point in time, labor in the United States was both available in steady supply and more than productive than in many other countries; hence it made sense to export labor-intensive appurtenances. Over the decades, many economists take used theories and data to explain and minimize the impact of the paradox. All the same, what remains articulate is that international trade is complex and is impacted by numerous and oft-changing factors. Merchandise cannot exist explained neatly by ane single theory, and more chiefly, our understanding of international trade theories continues to evolve.

Modern or Firm-Based Trade Theories

In contrast to classical, country-based merchandise theories, the category of mod, firm-based theories emerged afterwards Earth War Ii and was adult in large office by business schoolhouse professors, non economists. The firm-based theories evolved with the growth of the multinational company (MNC). The state-based theories couldn't adequately address the expansion of either MNCs or intraindustry merchandiseMerchandise between two countries of goods produced in the same industry. , which refers to trade between two countries of goods produced in the aforementioned industry. For example, Japan exports Toyota vehicles to Germany and imports Mercedes-Benz automobiles from Federal republic of germany.

Different the country-based theories, firm-based theories incorporate other product and service factors, including brand and customer loyalty, technology, and quality, into the understanding of merchandise flows.

Land Similarity Theory

Swedish economist Steffan Linder developed the country similarity theoryA modern, house-based international trade theory that explains intraindustry merchandise by stating that countries with the well-nigh similarities in factors such every bit incomes, consumer habits, market preferences, phase of technology, communications, caste of industrialization, and others will be more than likely to engage in merchandise between countries and intraindustry trade will exist common. in 1961, as he tried to explain the concept of intraindustry merchandise. Linder's theory proposed that consumers in countries that are in the same or similar stage of evolution would have like preferences. In this firm-based theory, Linder suggested that companies first produce for domestic consumption. When they explore exporting, the companies oft find that markets that look like to their domestic one, in terms of customer preferences, offer the most potential for success. Linder's state similarity theory then states that most trade in manufactured goods will exist between countries with similar per capita incomes, and intraindustry trade will be mutual. This theory is ofttimes nigh useful in understanding trade in goods where make names and product reputations are important factors in the buyers' decision-making and purchasing processes.

Production Life Cycle Theory

Raymond Vernon, a Harvard Business School professor, developed the product life wheel theoryA modern, firm-based international trade theory that states that a product life cycle has three distinct stages: (1) new product, (2) maturing production, and (3) standardized product. in the 1960s. The theory, originating in the field of marketing, stated that a production life wheel has three distinct stages: (1) new product, (2) maturing product, and (3) standardized product. The theory assumed that production of the new product will occur completely in the home country of its innovation. In the 1960s this was a useful theory to explain the manufacturing success of the United states of america. U.s.a. manufacturing was the globally dominant producer in many industries afterwards World War 2.

It has also been used to describe how the personal computer (PC) went through its production cycle. The PC was a new product in the 1970s and adult into a mature product during the 1980s and 1990s. Today, the PC is in the standardized product phase, and the majority of manufacturing and production process is washed in low-cost countries in Asia and Mexico.

The production life cycle theory has been less able to explicate current trade patterns where innovation and manufacturing occur effectually the world. For example, global companies fifty-fifty carry enquiry and development in developing markets where highly skilled labor and facilities are usually cheaper. Even though research and development is typically associated with the first or new product stage and therefore completed in the home country, these developing or emerging-market countries, such as Bharat and China, offer both highly skilled labor and new inquiry facilities at a substantial cost advantage for global firms.

Global Strategic Rivalry Theory

Global strategic rivalry theory emerged in the 1980s and was based on the piece of work of economists Paul Krugman and Kelvin Lancaster. Their theory focused on MNCs and their efforts to gain a competitive advantage against other global firms in their industry. Firms volition encounter global competition in their industries and in order to prosper, they must develop competitive advantages. The critical ways that firms can obtain a sustainable competitive advantage are called the barriers to entry for that industry. The barriers to entryThe obstacles a new firm may face when trying to enter into an industry or new market place. refer to the obstacles a new firm may face when trying to enter into an industry or new market. The barriers to entry that corporations may seek to optimize include:

- research and evolution,

- the ownership of intellectual belongings rights,

- economies of scale,

- unique business concern processes or methods as well equally all-encompassing experience in the industry, and

- the control of resources or favorable access to raw materials.

Porter'due south National Competitive Advantage Theory

In the continuing evolution of international merchandise theories, Michael Porter of Harvard Business School adult a new model to explicate national competitive advantage in 1990. Porter'southward theoryA modern, firm-based international trade theory that states that a nation's or firm's competitiveness in an industry depends on the chapters of the industry and firm to innovate and upgrade. In addition to the roles of government and chance, this theory identifies four key determinants of national competitiveneness: (1) local market resources and capabilities, (2) local market place need weather, (3) local suppliers and complementary industries, and (iv) local business firm characteristics. stated that a nation's competitiveness in an industry depends on the capacity of the manufacture to introduce and upgrade. His theory focused on explaining why some nations are more competitive in certain industries. To explain his theory, Porter identified four determinants that he linked together. The iv determinants are (1) local market resources and capabilities, (2) local market place demand weather condition, (3) local suppliers and complementary industries, and (4) local firm characteristics.

- Local market resource and capabilities (cistron weather). Porter recognized the value of the factor proportions theory, which considers a nation's resource (e.g., natural resource and available labor) equally fundamental factors in determining what products a country will import or consign. Porter added to these basic factors a new list of advanced factors, which he defined every bit skilled labor, investments in instruction, engineering science, and infrastructure. He perceived these advanced factors as providing a land with a sustainable competitive advantage.

- Local market need conditions. Porter believed that a sophisticated home marketplace is disquisitional to ensuring ongoing innovation, thereby creating a sustainable competitive advantage. Companies whose domestic markets are sophisticated, trendsetting, and enervating forces continuous innovation and the development of new products and technologies. Many sources credit the enervating U.s. consumer with forcing U.s. software companies to continuously introduce, thus creating a sustainable competitive reward in software products and services.

- Local suppliers and complementary industries. To remain competitive, large global firms benefit from having potent, efficient supporting and related industries to provide the inputs required by the industry. Sure industries cluster geographically, which provides efficiencies and productivity.

- Local firm characteristics. Local house characteristics include business firm strategy, industry structure, and industry rivalry. Local strategy affects a house's competitiveness. A salubrious level of rivalry betwixt local firms volition spur innovation and competitiveness.

In add-on to the iv determinants of the diamond, Porter also noted that government and gamble play a role in the national competitiveness of industries. Governments can, past their actions and policies, increase the competitiveness of firms and occasionally entire industries.

Porter's theory, along with the other modern, firm-based theories, offers an interesting interpretation of international trade trends. Nevertheless, they remain relatively new and minimally tested theories.

Which Merchandise Theory Is Dominant Today?

The theories covered in this chapter are simply that—theories. While they have helped economists, governments, and businesses ameliorate empathise international merchandise and how to promote, regulate, and manage information technology, these theories are occasionally contradicted past real-world events. Countries don't take accented advantages in many areas of production or services and, in fact, the factors of production aren't neatly distributed betwixt countries. Some countries accept a disproportionate do good of some factors. The United States has ample abundant country that tin be used for a broad range of agricultural products. It also has extensive access to capital. While it's labor pool may non exist the cheapest, it is among the all-time educated in the world. These advantages in the factors of production have helped the United states become the largest and richest economic system in the globe. Yet, the U.s. likewise imports a vast amount of goods and services, as U.s. consumers apply their wealth to purchase what they demand and want—much of which is now manufactured in other countries that have sought to create their own comparative advantages through cheap labor, country, or production costs.

As a result, it'due south not clear that any one theory is dominant around the world. This section has sought to highlight the basics of international trade theory to enable yous to sympathize the realities that face up global businesses. In do, governments and companies use a combination of these theories to both translate trends and develop strategy. Just as these theories have evolved over the past five hundred years, they volition continue to change and suit as new factors impact international trade.

Key Takeaways

- Merchandise is the concept of exchanging appurtenances and services betwixt two people or entities. International trade is the concept of this exchange between people or entities in two dissimilar countries. While a simplistic definition, the factors that impact trade are complex, and economists throughout the centuries take attempted to translate trends and factors through the evolution of trade theories.

- There are two main categories of international trade—classical, country-based and modern, firm-based.

- Porter'southward theory states that a nation's competitiveness in an industry depends on the capacity of the industry to innovate and upgrade. He identified four cardinal determinants: (1) local market resources and capabilities (cistron conditions), (2) local market demand atmospheric condition, (3) local suppliers and complementary industries, and (four) local business firm characteristics.

Exercises

(AACSB: Reflective Thinking, Analytical Skills)

- What is international trade?

- Summarize the classical, country-based international trade theories. What are the differences between these theories, and how did the theories evolve?

- What are the mod, firm-based international trade theories?

- Describe how a business may use the trade theories to develop its business organization strategies. Utilise Porter's four determinants in your explanation.

Source: https://saylordotorg.github.io/text_international-business/s06-01-what-is-international-trade-th.html

0 Response to "what strategy of modern manufacturing is adam smith referring to in this statement"

Postar um comentário